How to Enrich Your Commercial Property Management Fees

The strategy behind growing commercial property management fees will always be something separate and different to the commissions and the fees that you can get from sales and leasing activity. Any real estate brokerage business plan and team structure should consider the different fee types and the unique strategies required to grow those channels of income separately.

In defining the difference in focus here, you can say that the fees generated from brokerage sales and leasing activity are short-term generated and specifically earned per transaction. Property management fees, by contrast, will come from the stability of the client base, the management portfolio, and the types of property managed. Strategies will help the property management portfolio grow over time.

The fees earned from property management activity generate monthly, and those fees provide some real stability to the brokerage and its cash flow over time; most importantly they are generated consistently throughout the year while the sales and leasing market fluctuates.

There is one fact to remember here. It takes time to build a successful commercial property management portfolio of clients and buildings. Quality and size should always feature in the portfolio growth decisions and properties managed. The right people in the team should support the growth of the portfolio by serving the clients well.

The Property Management Fee and Service Facts

Here are some interesting facts to know:

- Some clients are more demanding than others when it comes to managing a property or a portfolio. Determine the client requirements as you set your fees for managing.

- The fees that you quote and earn from a managed building should allow for the expected time commitment and the tasks required to satisfy the client and their investment challenges. That is an important formula. A complex building can be subject to a calculation of time for management.

- Choose the property managers working in a brokerage business for both their skills and knowledge in the industry. There should also be a good selection of senior managers in the team to handle the complex properties and larger client accounts.

- When the property market slows from a sales and leasing perspective, the managed portfolio will provide stable listing stock for the sales and leasing team.

So, here’s are some interesting facts to remember. When the commercial sales and leasing market is slower or more challenging, it will be the property management portfolio that provides the stability to the brokerage. The portfolio of managed buildings will also be of some value when it comes to the sale of the brokerage business.

There are many income streams in commercial real estate brokerage. Certainly, you need the commissions and fees from sales and leasing activity in an ongoing way, so the strength and the coverage of your sales team will always be important to the growth of your brokerage business. A successful sales and leasing team will, however, allow the growth of the property management portfolio with quality buildings and good clients over time.

Growth Ideas

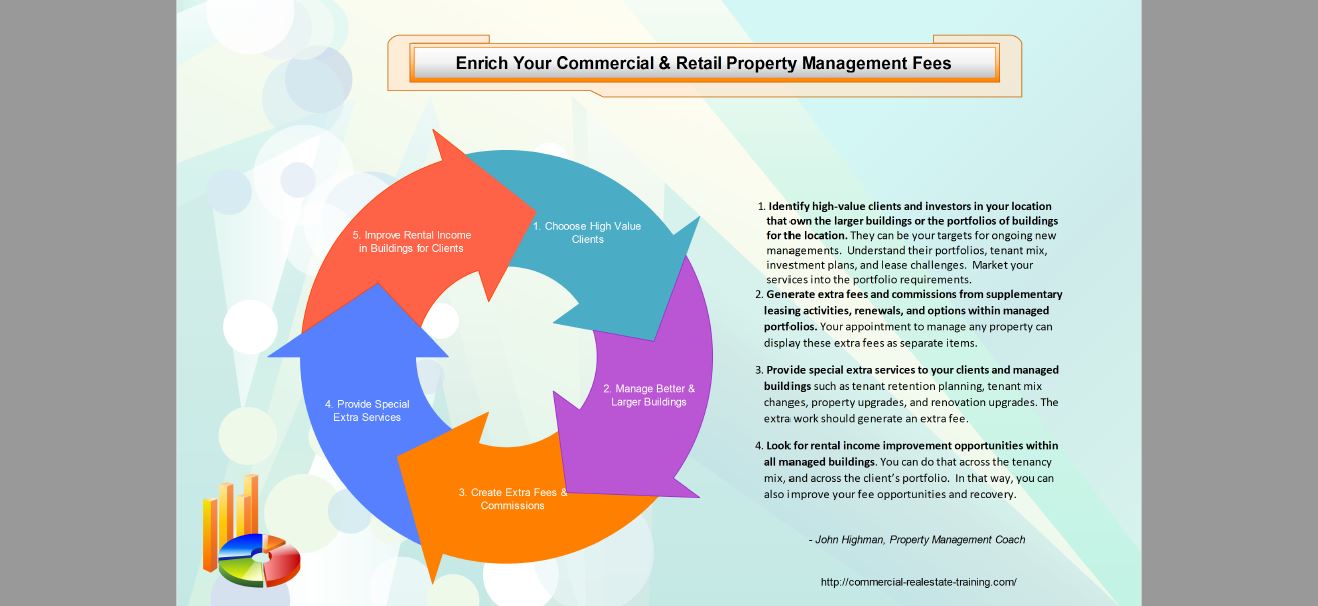

Here are some ideas to help you grow your property management fee base:

- Identify high-value clients and investors in your location that own the larger buildings or the portfolios of buildings for the location. They can be your targets for ongoing new managements. Understand their portfolios, tenant mix, investment plans, and lease challenges. Market your services into the portfolio requirements.

- Generate extra fees and commissions from supplementary leasing activities, renewals, and options within managed portfolios. Your appointment to manage any property can display these extra fees as separate items.

- Provide special extra services to your clients and managed buildings such as tenant retention planning, tenant mix changes, property upgrades, and renovation upgrades. The extra work should generate an extra fee.

- Look for rental income improvement opportunities within all managed buildings. You can do that across the tenancy mix, and across the client’s portfolio. In that way, you can also improve your fee opportunities and recovery.

There is a basic logic here. Every person in the property management team should be aware of the extra fee opportunities that they can generate from their managed buildings and the clients that they serve. You could say that it is a process of being ‘fee aware’. Clients and property owners need professional help in income stability and growth over time. Market your professional property management services accordingly.

You can get the property management chart right here: